Back in the first decade of the DSLR, I used to report quite a few statistics sets and use them to predict what was going to happen in the camera market. As it turns out, fairly reliably, as I was able to predict both peak ILC and when mirrorless would surpass DSLR pretty accurately. Once it became clear that we had achieved "peak camera", though, I stopped doing as much reporting on the data numbers I was seeing (both public and private). I still report on public data sets from time to time, but do so with much less frequency. This is the most recent such report.

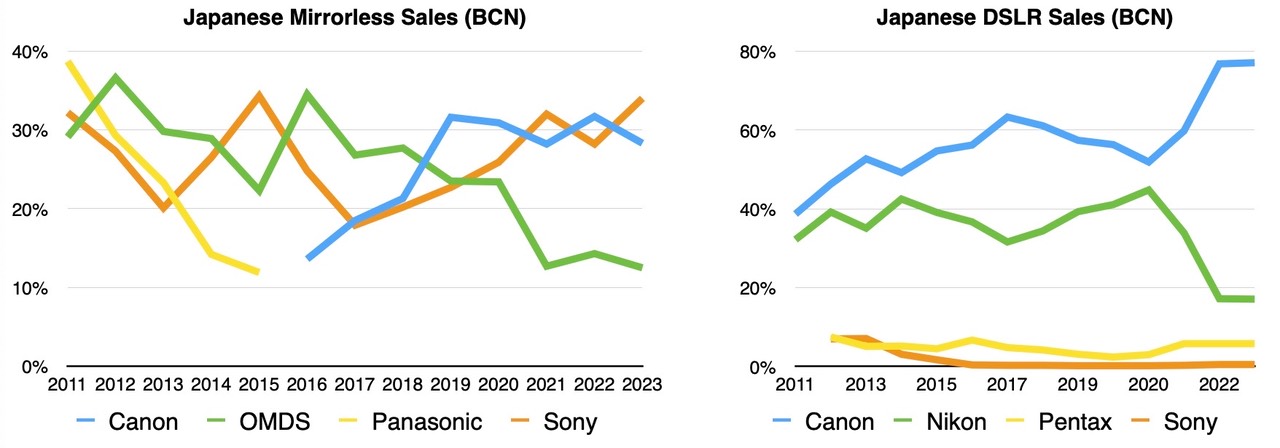

This time of year, all the photo sites trying to figure out something to say as they jump on the numbers coming out of Japan. Here are two market share data sets that have gotten a lot of play (in graph form):

I love the interpretations that come from others with this BCN data: "Nikon's doomed", "Pentax can't even gain share in a market that has no competitors", "Olympus [OMDS] is holding its own in mirrorless", and many more back seat economist conclusions.

As I've noted before, BCN tends to aggregate mostly lower end and chain store data in Japan. I don't believe they include any significant data from the big independent camera stores that sell higher end gear, but even if they did, the real thing the BCN data tells you is that camera volume in Japan is heavily weighted on price. That's because the top 10 selling cameras, according to BCN, are, in order: Sony ZV-E10, Sony A6400, Canon R50, Canon R10, Canon M2, Olympus E-P7, Nikon Zfc, Olympus E-PL10, Olympus E-M10 Mark IV, and Sony A7 Mark IV. That green OMDS line in the lefthand chart, above, are cameras that list for US$700 or less, and often have discounts from that in Japan.

Meanwhile, one of the big Japanese camera stores, Yodabashi, publishes its own list periodically, which also tends to get picked up as something meaningful by the same photography sites, even if it contradicts what those sites have already written. The top 10 compact cameras for the last two weeks of December in Japan were: Ricoh GR IIIx, OMDS Tough TG-7, Canon PowerShot SX740 HS, Canon IXY 650, Sony ZV-1 II, Ricoh GR III, Leica Q3, Kodak PixPro WPZ2, Ricoh GR IIIx Urban Edition, and Sony Cybershot RX100 Mark VII.

Which, of course, contradicts Yodabashi's own "Top 20 list for all of 2023." There, the order runs Sony A7 Mark IV, Nikon Z8, Sony A7R Mark V, Canon R6 Mark II, Sony A7 Mark IV with kit lens, Nikon Zfc with kit lens, Nikon Z50 double lens kit, Canon R50 double lens kit, Sony FX3, and Nikon Z9 as the top ten. Note no OMDS ILC.

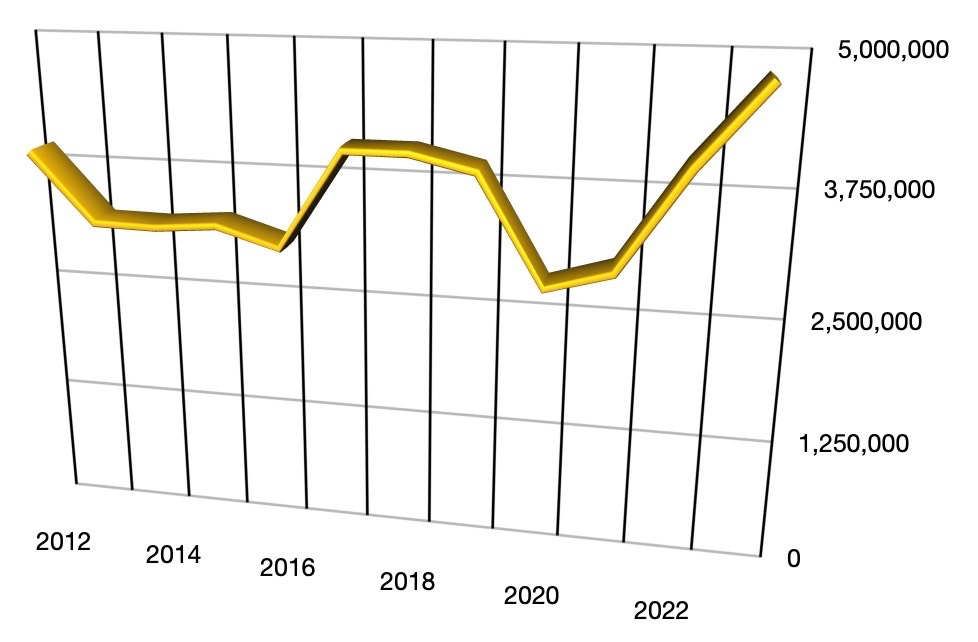

The Japanese chart that tells us the most isn't about the home market at all, it's CIPA's overall global sales volume figures. Here's the way global unit volume has changed since "peak ILC sales":

Overall, we're still trying to ascertain whether the modest growth since the pandemic-challenged 2020 drop is real growth or not. I'd say not. I believe that 6m ILC is the current point that things have fallen to from peak, and that it's only up from previous years because the Canon/Nikon full move into mirrorless has pressed everyone to intentionally push the market some. My current thought is that once the DSLR to mirrorless transition is complete and people have picked up more expensive mirrorless models, the buying activity among the photography faithful is going to again trend down some.

I wrote in 2019 that I believed that the base floor of ILC volume was somewhere between 4m and 6m units a year. I was worried that we'd drop to 4m, which would make it difficult for as many players as we have to stay with their heads above water. Since we are now seeing some new buyers in the market, I'm convinced at the moment that the worst case base is more likely something like 5 to 5.5m units. With sales and marketing promotion and perhaps some camera innovation, the Japanese companies might be able to keep pushing that above 6m units, but the natural buying I believe is below that.

I mentioned DSLR to mirrorless transition earlier. It's clear that we're deep into that now. Here's the volume of those ILC that are mirrorless tracked for the same period:

For 2023, ILC was almost exactly 6m units (fell ~1000 units short, though I've seen some sites report it as being over 6m). DSLR was just 19% of that, with mirrorless now a commanding 81% of ILC units coming out of Japan. It's going to get more lop-sided in 2024 for sure, as I believe Canon will essentially be end-of-lifing all DSLRs in 2024, and Nikon will be following not too far behind.

Meanwhile, Yodabashi also published it's list of the top selling lenses for 2023: 5 Sony, 5 Canon, 5 Nikon, 3 Tamron, and 2 Sigma zooms. That's correct, not a single prime lens made their top 20. Moreover, 12 of those lenses could be construed to be a form of mid-range zoom (e.g. 20, 24, 28, or 35mm at the wide end, 70, 105, 120, or 150mm at the long end). Four were long telephoto zooms (Canon 100-400mm and 100-500mm, Nikon 100-400mm and 180-600mm). That's not far off from some private data I've seen here in the US from retailers.

Looking at the register-based dealer sales numbers I've been shown for 2023 in the US, if I wanted to conclude anything from this year's collection of data in terms of higher-end photography gear, I'd say this: you're buying mirrorless with a mid-range zoom. Either a crop sensor camera just above the US$1000 mark, or a full frame camera in the US$2000-2500 range. The one surprise in that data set is that the higher-priced Z8 did so well. Demand is supposed to decline with price according to MBA teaching, but the Z8 sticks out like a sore thumb in the data, thumbing its nose at price elasticity of demand. At least in 2023. I'm not sure that'll hold true through 2024.

By the way, watch out for unclear statements about all these numbers that are getting reported. Amateur Photography magazine in the UK wrote "After crunching the latest numbers, used retailer MPB is predicting that the retail market will exceed its 2012 peak by next year." I have no idea what numbers they were crunching, but apparently some numbers were harmed in the process.

At first I thought they might have been referring to dollars taken in instead of units. But "peak ILC" produced 753,163,393,000 yen in 2012 and in 2023 we had 637,044,302,000 yen. We'd need 20% higher sales in 2024 to match the dollars taken back in 2012.

However, hidden in that (probable) mis-prediction is something that a lot of folk don't quite grok yet. In 2012, the average yen taken in per ILC unit was 37,400 yen. In 2023 it has grown to 106,000 yen. That's correct, the average ILC sold today is about 65% higher in revenue (at the manufacturer) than it was at peak. That outstrips (US) inflation during that period by about double. So yes, one of Japan's responses to your buying fewer cameras is to make more expensive cameras. That, unfortunately for Tokyo, is not a sustainable road to success, so it's a good thing that actual unit volume ticked up a bit this past year.